Toronto Real Estate Market: Trends, Analysis & Forecast for 2025–2026

Toronto Real Estate Market: Trends, Analysis & Forecast for 2025–2026

The Toronto real estate market remains one of the most closely watched housing sectors in Canada, with prices, sales activity, and inventory shifts influencing decisions for buyers, sellers, and investors across the GTA.

As the market transitions into late 2025 and early 2026, many Canadians are asking:

-

Are home prices going down?

-

Is it a good time to buy?

-

What will the next year look like?

This guide breaks down the latest market trends, current conditions, and forward-looking insights to help you make confident, strategic decisions in today’s evolving environment.

Overview of the Toronto Real Estate Market

The Toronto real estate market spans an extensive mix of detached homes, semis, townhomes, and high-rise condos across both the City of Toronto and the wider GTA. It is a market that is highly sensitive to interest rates, economic shifts, and demographic trends, and small changes often create noticeable effects in affordability and demand.

As of late 2025, the market is leaning in favour of buyers. Prices have softened, sales volumes remain muted, and inventory levels continue to rise compared to the high-competition years of 2020–2022.

Current Price Snapshot (Late 2025)

-

GTA Benchmark Price: approximately $951,700 (about –5.8% year-over-year)

-

Average GTA Sale Price: just above $1,000,000 (around –6% year-over-year)

-

Toronto Median Price: low-to-mid $800,000s (showing a modest decline)

Even with these declines, prices remain elevated compared to local income levels, which means affordability is still a major challenge for many buyers.

Analysis of the Current Toronto Housing Market

Multiple forces are shaping the Toronto real estate market in 2025:

1. Interest Rates & Borrowing Conditions

After a series of interest rate hikes, borrowing power has tightened for many buyers. Even with some recent easing into the mid-3% range for certain variable-rate products, higher qualification standards continue to limit what buyers can afford.

2. Population Growth & Immigration

Toronto continues to attract strong immigration and population growth. This long-term demand supports housing needs across both ownership and rental markets, even when sales volumes temporarily cool.

3. Sales Activity Trends

Across the GTA, home sales are down roughly 15–25% from pre-pandemic levels, depending on the property type and location. This reduction in sales activity has eased competition and reduced the frequency of bidding wars.

4. Inventory Levels

Active listings have increased, resulting in close to five months of housing supply in many areas. This is a key sign of a more balanced or slightly buyer-favoured market, compared to the tight conditions of previous years.

Overall, price changes have been controlled and gradual. Rather than a sharp crash, the market is experiencing a soft correction following the rapid appreciation seen from 2020 to 2022.

Toronto Real Estate Market Trends and Patterns

To navigate the Toronto real estate market successfully, it helps to understand the patterns emerging across different segments and regions:

Buyers Have Gained Negotiation Power

With more listings and fewer competing offers, buyers today have greater room to negotiate on price, conditions, and closing dates. Sellers are being more realistic with pricing and are often open to adjustments if a property sits on the market longer than expected.

Stronger Corrections in the 905 Region

Suburban areas in the 905 region saw some of the steepest price gains during the pandemic. As work and commuting patterns shift closer to pre-pandemic norms, these markets are experiencing more noticeable price corrections than some parts of the City of Toronto.

Downtown Toronto Condo Demand Remains Resilient

Condominiums in the downtown core continue to benefit from strong rental demand, urban amenities, and lifestyle appeal. While prices have adjusted, the condo segment has generally shown more stability than some detached markets further out.

Market Cycles Returning to Historical Norms

Historically, Toronto moves through cycles of rapid appreciation followed by periods of stabilization or mild decline. The current environment fits this typical pattern: a cooling and rebalancing phase after an unusually strong boom.

Toronto Real Estate Market Forecast & Outlook (2025–2026)

Looking ahead, most forecasts suggest that the Toronto real estate market will continue to adjust gradually rather than dramatically.

Short-Term Outlook (Next 6–12 Months)

-

Modest price declines may continue in some segments before stabilizing.

-

Sales volumes are expected to gradually improve as interest rates level off or ease.

-

The market is likely to remain balanced to slightly in favour of buyers.

Medium-Term Outlook (Into 2026)

-

A measured recovery is anticipated, driven by population growth, employment opportunities, and ongoing demand for housing near transit and key job centres.

-

Rapid price rebounds are not expected in the near term; instead, growth is likely to be slow and steady.

Opportunities for Buyers & Investors

With softened prices, higher inventory, and reduced competition, motivated and prepared buyers can find strong opportunities. Investors who focus on fundamentals, such as location, rentability, and long-term demand, may be able to secure properties with solid future upside.

Challenges in the Toronto Real Estate Market

Even with improving conditions for buyers, several important challenges persist:

Affordability Constraints

Despite recent price declines, the gap between home prices and average household incomes remains significant. This limits the pool of qualified buyers and can delay purchase timelines.

Mortgage Qualification Rules

Stress test rules and lending standards continue to make qualification more difficult, especially for first-time buyers and those with non-traditional income.

Regulatory and Policy Uncertainty

Policies affecting investors, vacant properties, and non-resident ownership can influence both demand and holding costs. These changes add complexity, particularly for investors evaluating long-term strategies.

Economic Volatility

Broader economic conditions, including employment trends, inflation, and interest rate decisions, continue to shape buyer confidence and market momentum.

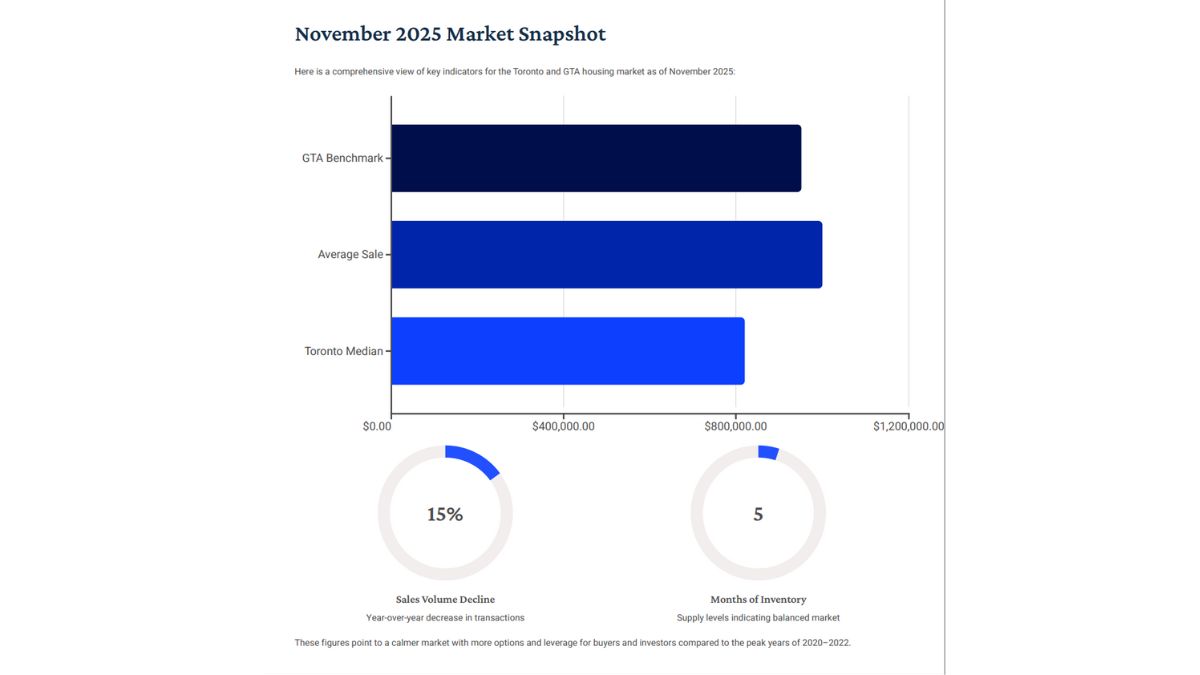

Toronto Real Estate Market Update – Key Stats (November 2025)

Here is a snapshot of key indicators for the Toronto and GTA housing market as of November 2025:

-

GTA Benchmark Home Price: approximately $951,700 (down about 5.8% year-over-year)

-

Average Sale Price in the GTA: just over $1,000,000 (down around 6% year-over-year)

-

Median Price in the City of Toronto: roughly $820,000 (showing a modest decline)

-

Sales Volumes: approximately 5,010 transactions (down roughly 15% year-over-year)

-

Months of Inventory: close to five months of supply in many areas, indicating a slower, more balanced market

Taken together, these figures point to a calmer market with more options and leverage for buyers and investors compared to the peak years.

Expert Guidance for Buyers & Investors

For Buyers

-

Get pre-approved early so you understand your budget and can act quickly on the right property.

-

Prioritize locations near transit, employment hubs, and strong school districts — these areas tend to hold value better over time.

-

Use longer days-on-market and higher inventory to negotiate on price, conditions, and closing dates.

For Investors

-

Set realistic expectations for rental income and year-over-year appreciation.

-

Focus on smaller, high-demand units in areas with strong rental fundamentals, such as downtown and transit-oriented neighbourhoods.

-

Stay up to date on policy changes that affect short-term rentals, vacant units, and investment ownership.

FAQ – Toronto Real Estate Market

Is the Toronto real estate market going down?

Yes. Data as of late 2025 shows prices down roughly 5–6% year-over-year in many segments. However, this is a controlled correction, not a sharp crash.

Will Toronto home prices continue to drop in 2026?

Minor declines may continue into early 2026 in some areas, but many forecasts suggest stabilization as interest rates and economic conditions become more predictable.

Is it a good time to buy a home in Toronto?

For financially prepared buyers with stable income and financing, this can be one of the better windows in recent years due to higher inventory, more negotiation power, and fewer bidding wars.

Which GTA regions are being impacted the most?

Suburban markets in the 905 region, especially those that saw the steepest pandemic-era price increases, have experienced more pronounced corrections than some central Toronto neighbourhoods.

What is the forecast for the Toronto real estate market over the next few years?

Most experts anticipate a period of stabilization followed by slow, steady growth, supported by long-term population growth, strong rental demand, and Toronto’s role as a major employment and cultural centre.

Conclusion – Navigating the Toronto Real Estate Market

Today’s Toronto real estate market is in a transition phase: prices are retreating from recent highs, inventory has increased, and sales activity has slowed.

While this creates challenges, particularly around affordability and financing, it also opens up opportunities for buyers and investors who are prepared, patient, and focused on long-term fundamentals.

By understanding key drivers such as interest rates, income levels, demographic trends, and government policy, you can make better-informed decisions about when and where to buy, sell, or invest.

In a market defined by gradual adjustment rather than sudden shocks, those who move thoughtfully and strategically are best positioned to benefit.

Sources and Further Reading

-

Toronto Regional Real Estate Board (TRREB) – Market data and reports:

https://trreb.ca/ -

Canada Mortgage and Housing Corporation (CMHC) – Housing Market Information:

https://www.cmhc-schl.gc.ca/en/professionals/housing-markets-data-and-research/housing-market-information -

Government of Canada – Understanding the Canadian housing market:

https://www.canada.ca/en/financial-consumer-agency/services/mortgages/understanding-housing-market.html

Categories

Recent Posts