Cost of Living in Oakville, Ontario (2026): What Home Buyers Really Need to Budget For

Cost of Living in Oakville, Ontario (2026): What Home Buyers Really Need to Budget For

If you’re researching the "cost of living in Oakville", you’re probably trying to answer a practical question:

“What will my monthly life cost after I buy a home here?”

Most generic “cost of living” pages don’t help home buyers because they don’t explain the "ownership cost stack", the expenses that change your monthly budget beyond the purchase price.

This guide is written for buyers and relocators who want to budget "all-in" (mortgage + taxes + utilities + commuting + maintenance + closing costs), with a clear way to compare Oakville to Toronto or other GTA areas.

If you haven’t yet, start with our relocation blog first (then come back to this one):

"Moving to Oakville, Ontario (Local Guide)"

https://www.thefurtadogroup.com/blog/Moving-to-Oakville--Ontario--The-Local-Guide-to-Neighbourhoods--Schools--Commute---Costs--2026-

Quick Answer

Oakville can feel more expensive than many nearby GTA areas primarily because housing costs can be premium, and ownership costs scale with home size and lifestyle. The most accurate way to plan is to budget your "all‑in monthly cost", not just the mortgage payment.

Use this all‑in checklist before you choose a home:

- Mortgage payment (or rent)

- Condo fees (if buying a condo)

- Property taxes (monthly equivalent)

- Utilities (electricity, gas, water, internet)

- Home insurance

- Maintenance reserve (repairs + seasonal upkeep)

- Transportation/commuting (GO vs driving + parking/tolls)

- One‑time closing costs (legal, land transfer tax, adjustments, moving)

What “Cost of Living” Means in Oakville for Home Buyers (Not Renters)

A big mistake is budgeting Oakville like it’s just “mortgage + groceries.”

For buyers, the true cost of living includes:

- Ownership costs (property taxes, utilities, insurance, maintenance)

- Location costs(commute time + transit/parking/tolls)

- One-time transaction costs (closing costs + land transfer tax)

- Home-type costs (condo fees vs freehold maintenance)

That’s why two buyers can purchase at similar prices and still have very different monthly realities.

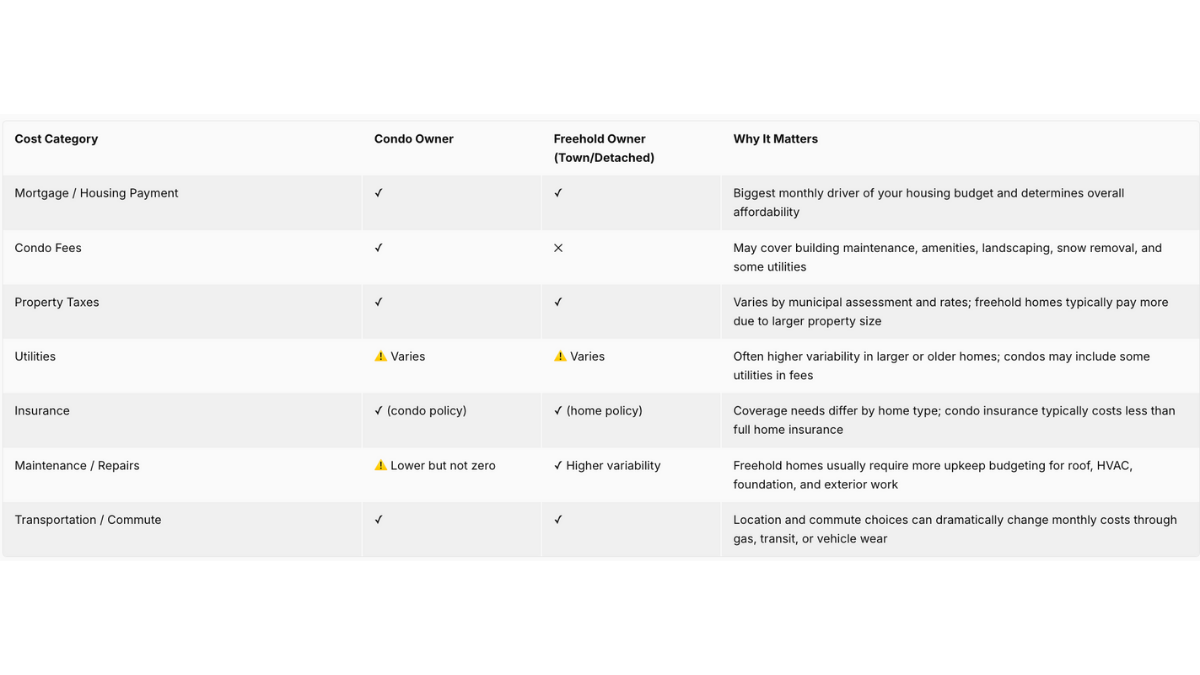

At-a-Glance: Oakville Cost Categories by Home Type

Use this table to compare the "type" of cost you’ll face (and which ones tend to change the most):

Step-by-Step: How to Estimate Your Monthly “All-In” Cost

If you want clarity fast, do this in order:

Step 1: Start with your housing payment

- Mortgage payment (or rent)

- Add condo fees if applicable

Step 2: Add your ownership stack (monthly equivalents)

- Property taxes (annual amount ÷ 12)

- Utilities estimate (more conservative if the home is older/larger)

- Insurance estimate

- Maintenance reserve (set aside a monthly buffer)

Step 3: Add your lifestyle/location costs

- GO fares + station parking OR driving costs (gas, parking, tolls if used)

- Childcare, recreation, and other household staples (your lifestyle will decide this)

Step 4: Add one-time costs to your “move budget”

Even if they’re not monthly, they affect affordability and stress:

- closing costs + legal

- land transfer tax

- moving costs + first-month purchases

For Ontario process context, this guide helps:

https://www.thefurtadogroup.com/blog/How-to-Buy-a-House-in-Ontario--A-Complete-Home-Buying-Guide

The 7 Biggest Cost Drivers in Oakville (What to Budget For)

1) Housing Costs (The Main Driver)

In Oakville, the same budget can “buy” very different outcomes depending on:

- condo vs freehold

- lot size vs interior size

- renovated vs renovation-ready

- neighbourhood micro-location (street-by-street differences)

**Buyer tip:** Don’t compare homes on price alone. Compare on "monthly cost and lifestyle fit".

To compare neighbourhoods the right way, use:

https://www.thefurtadogroup.com/oakville-neighbourhood-guide

2) Property Taxes (Often Underestimated)

Property taxes are one of the most common budget surprises for buyers relocating from:

- condos with different cost structures, or

- areas where taxes feel different relative to home value

How to budget safely:

- confirm property taxes for any home you’re serious about (during due diligence)

- treat taxes as a monthly line item (annual ÷ 12)

- plan a buffer for changes over time

**Where to verify:** see **External Resources** at the bottom (Town of Oakville + Halton Region + MPAC).

3) Utilities (Bigger Homes = Bigger Variability)

Utilities vary widely based on:

- home size

- insulation/windows

- heating/cooling systems

- family size and usage habits

Condo vs freehold reality: condos may bundle some costs into fees (building dependent), while freehold ownership typically has more month-to-month variability.

4) Transportation & Commuting (This Can Quietly Become Huge)

Oakville commuting costs depend on your routine:

- GO Transit + station access/parking

- driving + paid parking + fuel/maintenance

- toll routes (if you use them regularly)

This is why neighbourhood choice matters. A “great house” can become a daily frustration if your commute friction is high.

This section pairs well with the our article we wrote, if you’re still choosing areas:

https://www.thefurtadogroup.com/blog/Moving-to-Oakville--Ontario--The-Local-Guide-to-Neighbourhoods--Schools--Commute---Costs--2026-

5) Insurance (Different for Condo vs Freehold)

Insurance pricing depends on the property and coverage choices, but the planning point is simple:

Get an early estimate if you’re comparing:

- older homes vs newer builds

- different home sizes

- homes with different renovation histories

6) Maintenance & Repairs (The Ownership Reality Category)

Maintenance is not a scare tactic, it’s a normal part of homeownership.

Budget For:

- seasonal upkeep (snow, lawn, gutters)

- periodic replacements over time (HVAC, roof, windows, appliances)

- “first year” purchases after move-in (even in good condition)

**If you want lower variability:** certain home types and conditions will generally be more predictable than others.

7) One-Time Closing Costs (The “Cash Needed” Category)

Even buyers with strong monthly affordability can get caught by closing costs.

Start with these internal resources for Ontario context:

- Closing costs guide: https://www.thefurtadogroup.com/blog/closing-costs-toronto-2025

- Ontario land transfer tax: https://www.thefurtadogroup.com/blog/Understanding-Ontario-Land-Transfer-Tax--What-Every-Buyer-Should-Know

All-In Monthly Budget Worksheet (Download)

Instead of guessing what a home will actually cost you each month, use our All-In Monthly Budget Checklist to compare properties side-by-side based on real ownership expensesnot just the purchase price.

This worksheet helps you account for:

-

housing payments

-

property taxes

-

utilities

-

insurance

-

maintenance

-

commuting costs

👉 Click here to download our free All-In Monthly Budget Checklist

This tool is for general planning purposes only and does not constitute financial, legal, or tax advice.

Oakville vs Toronto: Is Oakville More Expensive to Live In?

The honest answer is: "it depends on what you’re comparing and how you live."

What often makes Oakville feel more expensive

- housing costs in many pockets (especially for more space/larger lots)

- ownership costs that scale with home size (utilities + maintenance)

- driving-related expenses if your routine becomes more car-dependent

What can balance out (depending on your lifestyle)

- if you move from a very high-cost Toronto housing situation into a different home type

- if your routine becomes more local (less downtown parking/spend)

- if GO becomes your reliable commute option vs driving daily

**Best practice:** compare your *personal* all‑in monthly stack in both places using the same categories.

3 “Real World” Budget Scenarios (Examples Only)

These are "illustrations" to show how the cost stack works, not quotes and not predictions.

Scenario 1: Condo Owner (Predictability Focus)

Common Stack Includes:

- mortgage + condo fees

- property taxes

- insurance (condo policy)

- utilities (varies by building)

- commuting (GO or driving)

**Best for:** buyers who want lifestyle + lower maintenance variability.

Scenario 2: Townhome Owner (Balanced Space + Cost)

Common Stack Includes:

- mortgage

- property taxes

- utilities (more variability than many condos)

- insurance (home policy)

- maintenance reserve

- commuting

**Best for:** buyers who want more space but still want manageable upkeep.

Scenario 3: Detached Home Owner (Space + Variability)

Common Stack Includes:

- mortgage

- property taxes

- utilities (often highest variability)

- insurance

- maintenance reserve (important)

- commuting

**Best for:** buyers prioritizing space, lot, and long-term flexibility—who are comfortable budgeting for upkeep.

The 10 Questions That Prevent “Cost of Living” Surprises

Before you buy, ask:

1) What are property taxes for this exact home (not the neighbourhood average)?

2) Are there condo fees (and what do they include)?

3) What utilities will I be responsible for?

4) What’s the commute plan (GO vs driving), and what will it cost monthly?

5) How old are the major systems (roof, HVAC, windows)?

6) What maintenance will I inherit in the first 12–24 months?

7) How will my lifestyle spending change (parking, transit, childcare, activities)?

8) What are my one-time closing costs and cash needed?

9) Do I have a buffer for surprises (move-in costs + repairs)?

10) Does this home fit my routine, not just my wishlist?

Local CTA: Want a Custom Oakville “All‑In Budget” + Neighbourhood Shortlist?

If you tell us:

- where you’re commuting (and how often)

- your preferred home type (condo / town / detached)

- whether schools matter

- your comfort range for an all‑in monthly budget

…we can help you shortlist Oakville neighbourhoods and home types that match your routine and budget.

If you’re also selecting representation, this may help:

https://www.thefurtadogroup.com/blog/how-to-choose-a-realtor-in-Oakville-Toronto

**[IMAGE PLACEHOLDER 3 — Commute/Lifestyle]**

*Suggested image:* GO station / commuter scene OR Oakville trails/parks lifestyle image

*File name:* oakville-commute-and-lifestyle-costs.jpg

*Alt text:* Commuting and lifestyle factors that affect cost of living in Oakville, Ontario

FAQ (AI + Featured Snippet Optimized)

How much does it cost to live in Oakville, Ontario?

It varies by home type, household size, and commute pattern. For buyers, the most accurate method is calculating an **all‑in monthly cost** including housing, property taxes, utilities, insurance, maintenance, and commuting, not just the mortgage.

What costs do buyers underestimate most in Oakville?

The most common misses are **property taxes, utilities (especially moving from condo to freehold), maintenance/repairs, and commuting costs**.

Is Oakville more expensive than Toronto?

Sometimes yes, sometimes no, depending on what you’re comparing (condo vs detached), where you work, and how you commute. Compare both locations using the same monthly cost categories.

How do I estimate property taxes in Oakville?

Use the property’s current tax information (during due diligence) and reference official municipal/regional resources. See **External Resources** below for where to verify.

What should I budget for beyond the mortgage?

At minimum: property taxes, utilities, home insurance, a maintenance reserve, commuting costs, and one-time closing costs.

Is condo living in Oakville cheaper than freehold ownership?

Condo ownership can be more predictable (fees + building responsibilities), while freehold ownership can have higher variability (utilities + maintenance). “Cheaper” depends on your priorities and total monthly stack.

What’s the biggest “hidden cost” when moving to Oakville?

For many buyers it’s the combination of **closing costs + move-in expenses + maintenance**, especially when upgrading to a larger home.

Important Disclaimer

This article is for general informational purposes only and does not constitute legal, tax, or financial advice. Costs vary by property, household, and market conditions. Always verify details with official sources and qualified professionals.

External Resources (Credible Links)

(Listed here so your article stays clean and internally focused while still being verifiable.)

- Town of Oakville — Property tax assessments hub: https://www.oakville.ca/home-environment/property-tax-assessments/

- Town of Oakville — Tax due dates & payments: https://www.oakville.ca/home-environment/property-tax-assessments/tax-due-dates-payments/

- Town of Oakville — Tax rates: https://www.oakville.ca/home-environment/property-tax-assessments/tax-rates/

- Halton Region — Property taxes: https://www.halton.ca/the-region/finance-and-transparency/property-taxes

- MPAC — Understanding your assessment: https://www.mpac.ca/en/UnderstandingYourAssessment

- GO Transit — Plan your trip: https://www.gotransit.com/en/plan-your-trip

- Government of Ontario — Land transfer tax: https://www.ontario.ca/document/land-transfer-tax

- CREA — Oakville-Milton & District board stats: https://stats.crea.ca/board/oakv/

Categories

Recent Posts